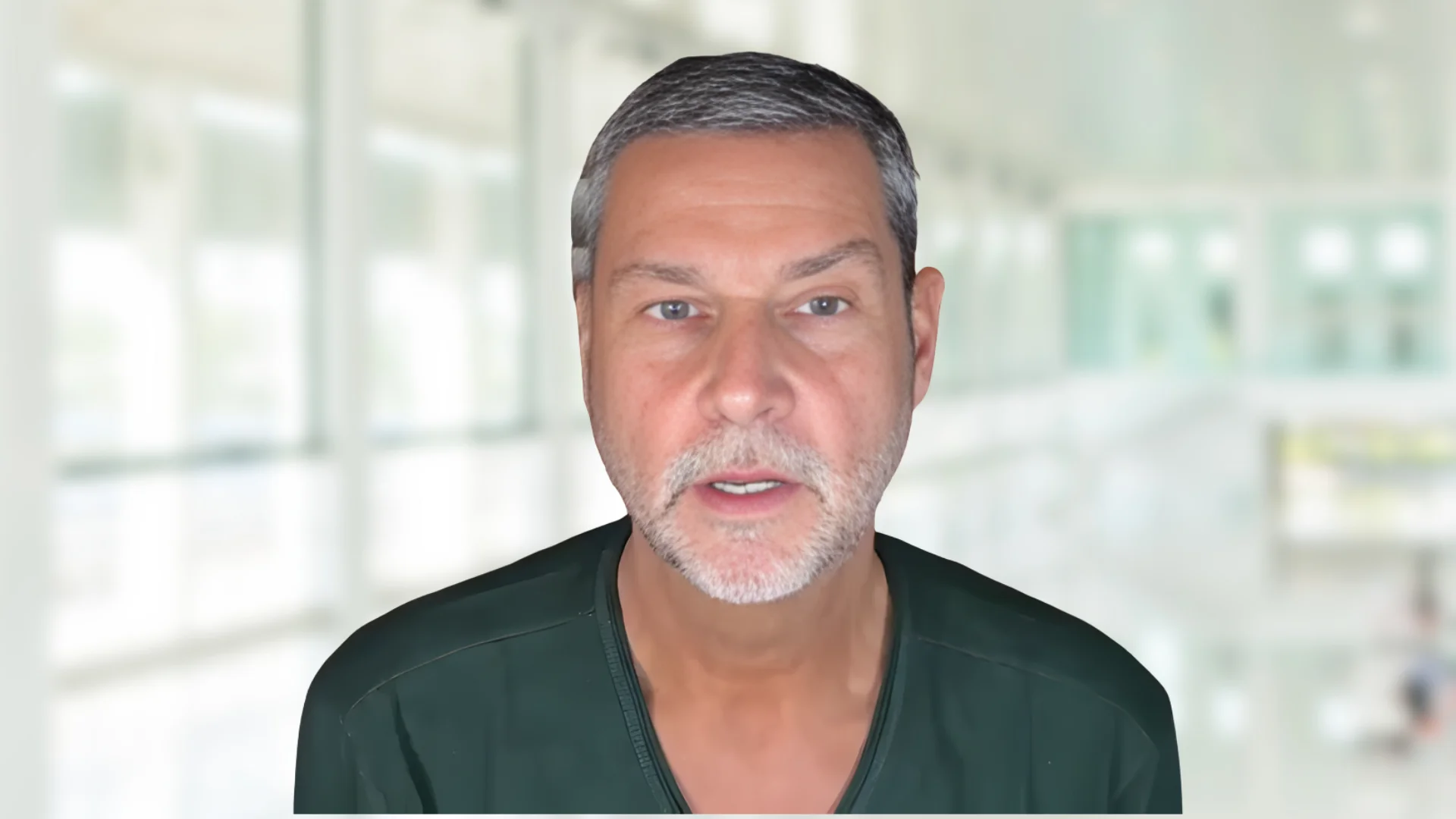

Carlos Domingo, CEO of Securitize, has expressed confidence in blockchain technology's potential to transform asset management. He said on X that the advantages of blockchain as a ledger will lead to widespread tokenization of assets within five to ten years.

"If you want to explain to someone who does not understand crypto why all the assets in the world will be tokenized, the simple answer is that a blockchain is a better ledger," said Domingo. "There's $400 trillion out there of assets that could potentially be tokenized. It's an upgrade … within the next five to 10 years, you will see everything will be on-chain, because it's just a better ledger."

Real-world asset (RWA) tokenization saw significant growth between 2024 and 2025, driven by regulatory pilots and institutional interest. The World Economic Forum reports that global tokenization initiatives now encompass bonds, funds, and commodities. These efforts are supported by the European Union’s Distributed Ledger Technology (DLT) Pilot Regime and U.S. examples such as BlackRock’s BUIDL tokenized fund. These frameworks demonstrate how regulators are incorporating blockchain into traditional finance systems to facilitate real-time settlement and transparent ownership.

Alerts Sign-up

Alerts Sign-up