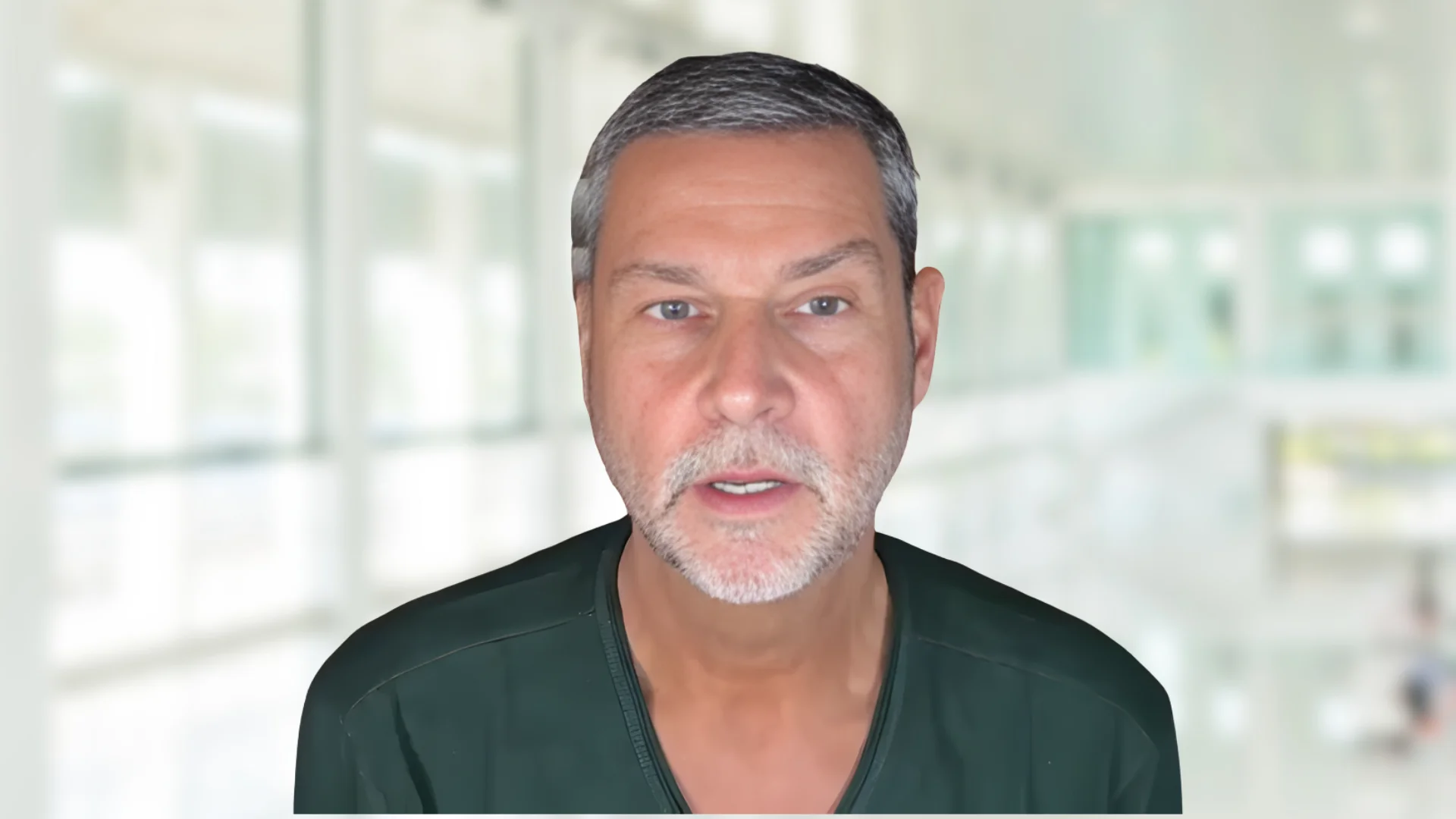

Michael Saylor, executive chairman of Strategy, said that the company's adoption of the Bitcoin Standard has driven performance exceeding all asset classes and top technology stocks over the past five years. The statement was made on X.

"Five years ago, $MSTR adopted the Bitcoin Standard," said Saylor. "Since then, we've outperformed every asset class and every Magnificent 7 stock. You can now track our annualized results daily at http://Strategy.com."

Strategy, formerly known as MicroStrategy, has transitioned to a Bitcoin Standard by using equity and debt issuance to finance large-scale Bitcoin purchases, making Bitcoin its primary reserve asset. According to the Financial Times, this approach creates a cycle where rising Bitcoin values enhance the firm's capital-raising capacity, enabling further acquisitions. However, critics warn of extreme volatility exposure for shareholders.

Alerts Sign-up

Alerts Sign-up