The Digital Operational Resilience Act (DORA) enhances European Union (EU) financial regulation, requiring entities to bolster their ability to withstand Information and Communication Technology (ICT) disruptions, mitigate cyber risks, and maintain stability across the sector. The new regulation, effective January 17, 2025, was detailed on the DORA website on January 17.

DORA establishes a unified EU framework for managing ICT risks in the financial sector, addressing gaps in existing regulations. It mandates financial entities to implement robust risk management, report incidents, conduct resilience testing, and oversee third-party ICT providers. Aimed at enhancing stability and security across the EU financial system, DORA will come into effect on January 17, 2025.

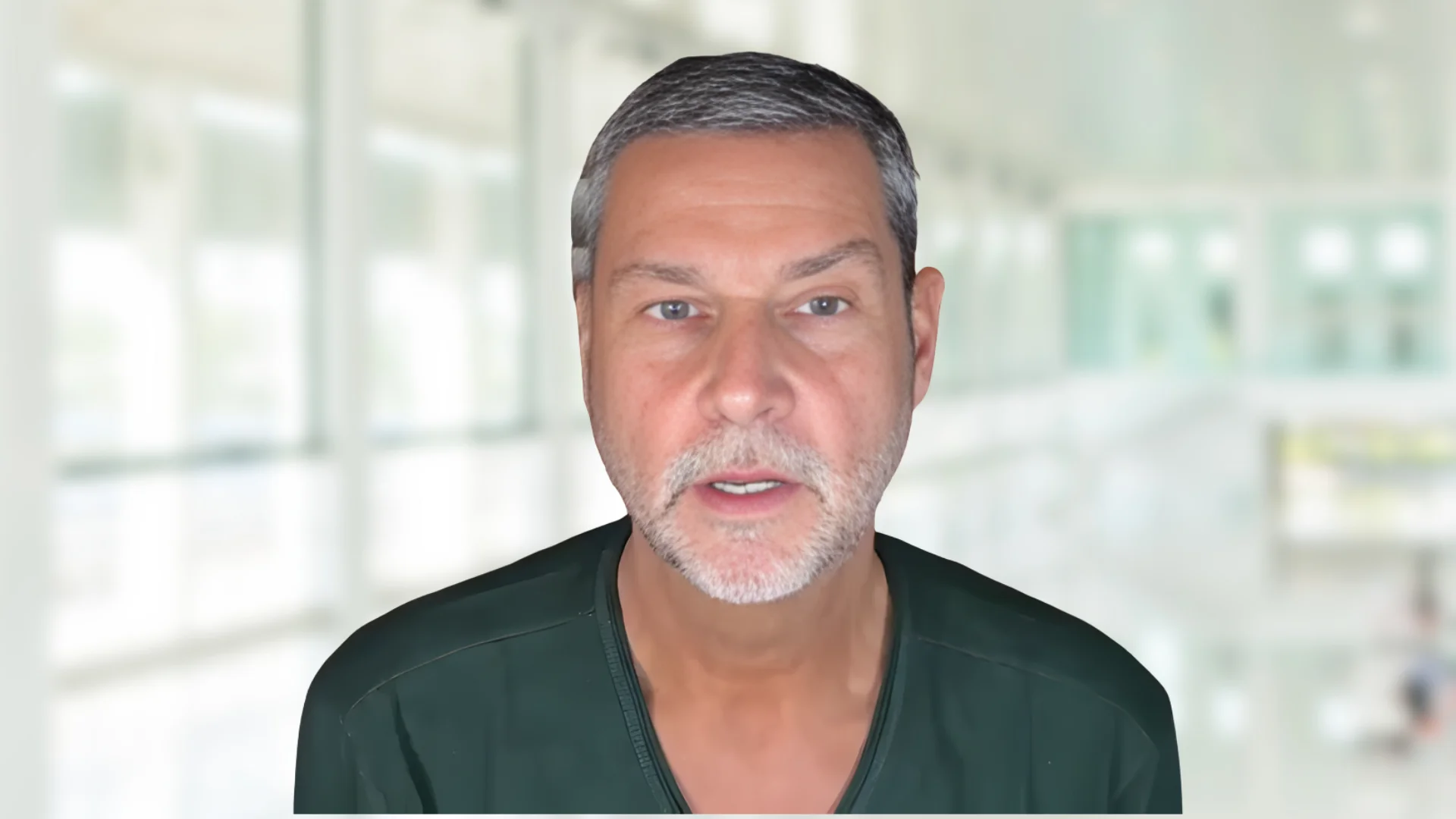

Reported by Cointelegraph, Matt Sullivan, Deputy General Counsel at MoonPay, said that DORA significantly impacts Markets in Crypto-Assets (MiCA)-licensed crypto firms by imposing stringent cybersecurity and operational resilience requirements. MoonPay has mobilized internal teams to ensure compliance, updating vendor relationships and maintaining a DORA-compliant register. These measures aim to align with DORA's focus on safeguarding digital asset operations and enhancing investor protection.

Alerts Sign-up

Alerts Sign-up