Marina Markezic, director and co-founder of the European Crypto Initiative (EUCI), has described the call by the European Stability Mechanism (ESM) Managing Director to revise the Markets in Crypto-Assets (MiCA) regulation as "premature." She expressed her views in a post on X dated March 13.

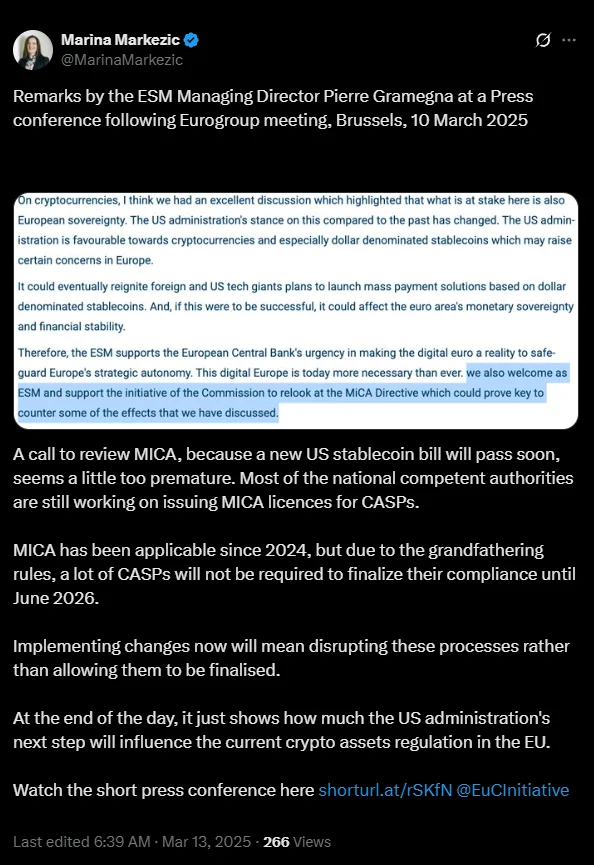

"Remarks by the ESM Managing Director Pierre Gramegna at a Press conference following Eurogroup meeting, Brussels, 10 March 2025," said Markezic. "A call to review MICA, because a new US stablecoin bill will pass soon, seems a little too premature. Implementing changes now will mean disrupting these processes rather than allowing them to be finalised. At the end of the day, it just shows how much the US administration's next step will influence the current crypto assets regulation in the EU."

Markezic's comments were in response to ESM Managing Director Pierre Gramegna’s support for the European Commission’s proposal to review the MiCA framework. She noted that many regulators are still issuing licenses, and firms have until 2026 to comply with the regulations. Markezic emphasized that U.S. policy will significantly "influence" crypto regulation within the EU.

Marina Markezic's post

| X

Alerts Sign-up

Alerts Sign-up