Georg Brameshuber, a cryptocurrency advisor, has expressed concerns over Germany's taxation policies on unclaimed staking rewards. He said that the country is "falling behind" due to these tax measures, which include blocking loss offsets and enforcing a complex cost basis. Brameshuber urged the ecosystem to "step up" or risk weakening. His comments were made in a March 8 post on X.

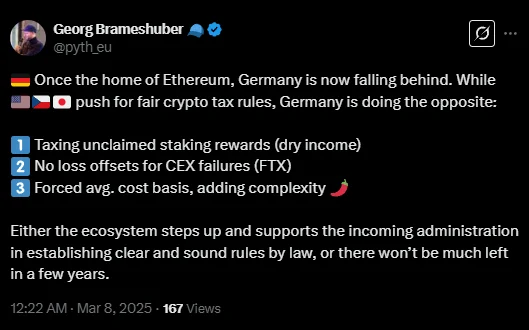

"Once the home of Ethereum, Germany is now falling behind," said Brameshuber, crypto advisor and co-founder. "While [USA, Czech Republic, Japan]push for fair crypto tax rules, Germany is doing the opposite. 1. Taxing unclaimed staking rewards (dry income) 2. No loss offsets for CEX failures (FTX) 3. Forced avg. cost basis, adding complexity. Either the ecosystem steps up and supports the incoming administration in establishing clear and sound rules by law, or there won't be much left in a few years."

In Germany, staking rewards are classified as taxable income upon receipt and are subject to personal income tax rates. This policy applies regardless of whether the rewards are claimed or sold, leading individuals to potentially face tax obligations based on the value of the rewards at the time they are received. According to Blockpit, this approach contrasts with other jurisdictions where staking rewards may only be taxed upon sale. The policy aims to align staking rewards with other forms of income under German tax law, requiring individuals to account for these assets when calculating their annual tax liabilities.

Georg Brameshuber's post

| X

Alerts Sign-up

Alerts Sign-up