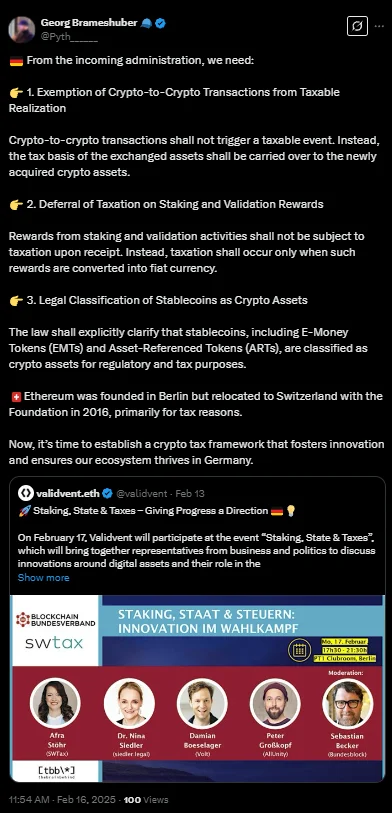

Georg Brameshuber, a crypto advisor, has emphasized the need for Germany to establish a crypto tax framework that encourages "innovation" and the growth of the "ecosystem," as well as the "legal classification of stablecoins as crypto assets." Brameshuber made these statements in a February 16 post on X.

"From the incoming administration, we need: Exemption of Crypto-to-Crypto Transactions from Taxable Realization," said Brameshuber, crypto advisor and co-founder. "Crypto-to-crypto transactions shall not trigger a taxable event. Instead, the tax basis of the exchanged assets shall be carried over to the newly acquired crypto assets. Legal Classification of Stablecoins as Crypto Assets. The law shall explicitly clarify that stablecoins, including E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs), are classified as crypto assets for regulatory and tax purposes. Now, it's time to establish a crypto tax framework that fosters innovation and ensures our ecosystem thrives in Germany."

In his post, Brameshuber outlines key proposals for Germany's incoming administration. He calls for the "exemption of crypto-to-crypto transactions from taxable realization," where the tax basis is carried over to new assets. He also advocates for the "deferral of taxation on staking and validation rewards," with taxes only applying when converted to fiat currency. Additionally, he urges the "legal classification of stablecoins as crypto assets," specifically E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs).

Georg Brameshuber's post

| X

Alerts Sign-up

Alerts Sign-up