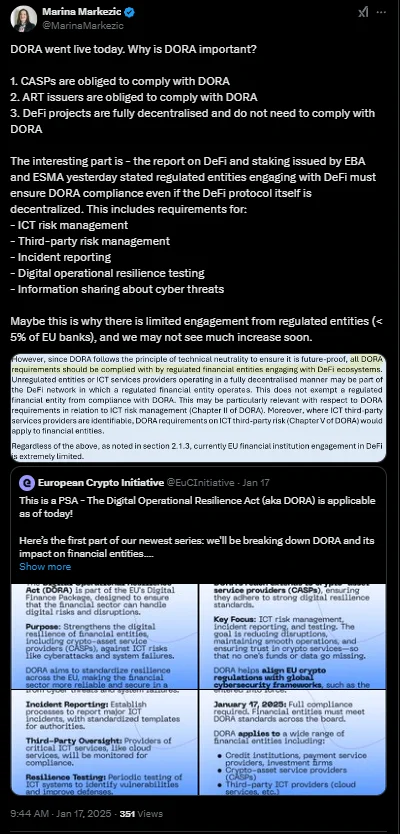

Marina Markezic, director and co-founder of the European Crypto Initiative (EUCI), emphasized the importance of regulated entities involved with decentralized finance (DeFi) ensuring compliance with the Digital Operational Resilience Act (DORA). Markezic made her statement in a January 17 post on X.

"DeFi projects are fully decentralised and do not need to comply with DORA," said Markezic. "The interesting part is - the report on DeFi and staking issued by EBA and ESMA yesterday stated regulated entities engaging with DeFi must ensure DORA compliance even if the DeFi protocol itself is decentralized."

According to Markezic, a report from the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA) on DeFi and staking indicates that while DeFi projects are not required to comply with DORA, regulated entities interacting with them must ensure compliance. This includes adhering to information and communication technology (ICT) risk management, third-party risk management, incident reporting, resilience testing, and information sharing on cyber threats.

Marina Markezic's post

| X

Alerts Sign-up

Alerts Sign-up